Economics | European Common Agricultural Policy (CAP) | #economics

https://global-fintech.blogspot.com/2016/01/CAP-european-common-agricultural-policy.html

Until Brexit, it seems that no one questioned the economics of European integration. Brexit, however, has raised doubts about major instruments of EU politics, especially as far as economics is concerned. The European Common Agricultural Policy (CAP) is one of the cornerstones of European integration and deserves a special attention. In this post, we are going to discuss the CAP from the perspectives of International economics and Microeconomics. | #economics

|

| International Economics | European Common Agricultural Policy (CAP) as part of the European integration |

Understanding the European Common Agricultural Policy (CAP)

European integration and the European Common Agricultural Policy (CAP) history

The European Common Agricultural Policy (CAP) was created soon after the starting point of the European integration. In 1957 Germany, France, Italy, Belgium, the Netherlands, and Luxembourg formed the European Economic Community, which after a certain amount of time evolved into the European Union (EU) spreading to 26 countries. The initial steps of the European integration were directed at economic integration. They consisted in creating the customs union and removing all tariffs between the participating countries.

What is the European Common Agricultural policy? In 1962 the European Common Agricultural Policy (CAP) was devised in order to guarantee high prices to European farmers and at the same time protect them from international competitors by means of tariffs. The European CAP served as an incentive for famers to continue their businesses. Therefore, the main task of the CAP was to make incentives for farmers to produce enough food for the European countries by guaranteeing them profitability.

Today the EU has become one of the key participants in World Trade Organization negotiations on agricultural trade and accounted for 15-20 % of the world's agricultural exports and imports. Whereas the initial motivation of European integration was of economic character, today it is no longer the case. The current EU agenda demonstrates clearly enough that the EU is no longer a group of independent countries seeking their profit in broader economic integration, but an instrument in the hands of influential political forces.

In the near future, however, the situation may change. Let's investigate the peculiarities of the CAP by applying the instruments of Microeconomics and International Economics.

Today the EU has become one of the key participants in World Trade Organization negotiations on agricultural trade and accounted for 15-20 % of the world's agricultural exports and imports. Whereas the initial motivation of European integration was of economic character, today it is no longer the case. The current EU agenda demonstrates clearly enough that the EU is no longer a group of independent countries seeking their profit in broader economic integration, but an instrument in the hands of influential political forces.

In the near future, however, the situation may change. Let's investigate the peculiarities of the CAP by applying the instruments of Microeconomics and International Economics.

Mechanism: How the European Common Agricultural Policy (CAP) works

The European Common Agricultural Policy summary:

The economics of the European Common Agricultural Policy (CAP) is easy. The EU provides its farmers with a domestic price support for farm products such as meat, grains, dairy products and sugar. Should prices fall below the specified support level, the EU government purchases the agricultural products at the minimum price.

International Economics and the European Common Agricultural Policy (CAP)

Instruments of trade policy in international economics

The most important instruments of trade policy in international economics are the following:

- tariffs (taxes levied for imported goods)

- export subsidies (payments for home producers who export their goods)

- import quotas (restrictions on imports).

European Common Agricultural Policy (CAP) in international economics

From the point of view of international economics, CAP manifests itself first and foremost by the export subsidy. It exists in order to offset the difference between the prices inside the EU and world prices and support exports to dispose of surplus production. However, as the prices for farmers became lower than the specified support levels and the European authorities bought more and more agricultural products, the CAP started to attract less expensive imports. That motivated the European authorities to apply tariffs, Thus, it can be seen that the European CAP is a combination of tariffs and export subsidies. Such a policy has resulted in pressure from other food-exporting nations, among others the United States. The reason was that the European CAP drove down the price of their exports.

The EU, being a customs union, not a free trade area, still has trade tariffs among its member states. The average tariff is equal to 3-4 %. A car tariff is 10 % and an average tariff on agricultural products amounts at 18 per cent. That fact points out that the CAP as such cannot reach its full efficiency until the European integration develops more in the economic direction, transferring the union into a free trade zone.

Microeconomics of the European Common Agricultural Policy (CAP)

In order to understand the microeconomics of the European Common Agricultural Policy (CAP), it is necessary to see behind the main points of the policy:

- EU farmers are guaranteed prices above the world level by EU governments.

- EU consumers pay higher prices for agricultural products.

- EU government finances subsidies for EU farmers by setting higher prices for agricultural products for EU consumers.

The notions of the price floor and the trade tariff which are facilitated by the framework of the free trade model of international economics, enable us to see more precisely how the aforementioned points work.

The European Common Agricultural Policy (CAP) Price Floor Mechanism

The main instrument of the European Common Agricultural Policy (CAP) is the price floor for agricultural products. The price floor is set above the world price level (pw), but below the self-sufficiency point (pss) - the point where the market clears and home supply is equal to home demand so that no import or exports are necessary (such a situation is hardly imaginable in real life, but it can be used in international economics to demonstrate various economic phenomena).

|

| European Common Agricultural Policy (CAP) | Economics of the Price Floor |

The direct implication of the CAP's price floor is that EU farmers can produce less than they have done so far in order to be profitable and gain the surplus of A. As the production falls from Z to Zf, the consumption decreases as well. Instead of consuming the amount C, EU consumers now buy Cf because agricultural products have become more expensive and they lose part of their surplus C2 due to the tariff. Altogether, their surplus has fallen by A + B + C1 + C2. The surplus of the EU government is B (see the illustration above).

Nevertheless, historically despite the fall in surplus, the EU consumers were not unhappy about the CAP. First, in the 1950s their incomes rose much more rapidly than food prices. Second, after the food shortages of WWII the EU consumers were reassured that the thanks to the CAP food was in abundance. Finally, farming is considered a respectful activity in Europe and everyone was satisfied that it enjoyed stability and prosperity.

The European Common Agricultural Policy (CAP) Tariff

The price floor is enabled by means of the CAP tariffs which are supposed to hold the price of agricultural products above pw, more precisely at the level pw + T. As pw for agricultural products are highly volatile due to the price instability on food markets, the tariffs should be adjusted in order to maintain the price floor. For instance, if the pw rises (pw'), the tariff should be decreased (T').

|

| European Common Agricultural Policy (CAP) | Economics of the Variable Tariffs |

Producing Zf in the presence of the price floor, EU farmers are guaranteed high prices through the mechanism of production subsidies. They sell their produce at the price pw and receive a compensation in form of the production subsidy equal to T. Thus, they sell their produce for pw + T.

For EU consumers, the situation is inverse. More precisely, they pay higher prices for the CAP by buying the amount of Cf at the price equal to pw + T where T is perceived as a consumption tax (a kind of food tax).

EU government gets Cf * T (in form of the consumption tax) and loses Zf * T (in form of the subsidy payment), thus generating the revenue of (Cf - Zf) * T = B (tariff revenue).

Evolution of the European Common Agricultural Policy (CAP) and export subsidy

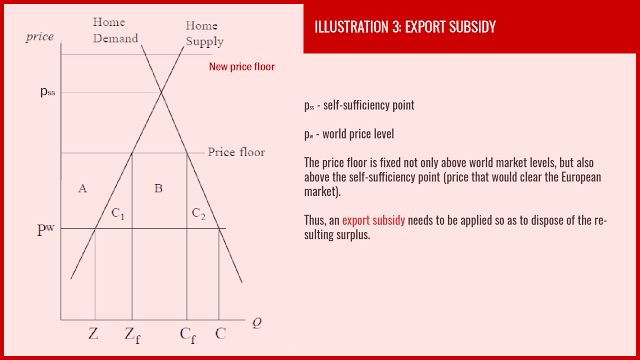

As the time went by, the CAP authorities were setting a higher price floor. Eventually, the price floor started to be set at the level which was higher the self-sufficiency point (where home demand was equal to home supply). That situation resulted in the surplus of agricultural products compiling in stocks. In order to get rid of it, the EU initiated an export subsidy that allowed to sell the stocks of agricultural products on the global market at the prices which were lower than the cost of production of the agricultural products.

|

| European Common Agricultural Policy (CAP) | Export Subsidy |

By offsetting the price difference between the products coming from Europe and other countries, the subsidised exports affected the world price. In most cases, they decreased it, which brought about the necessity of increasing the export subsidies.

Economic Impacts of the European Common Agricultural Policy (CAP)

Today, the CAP represents a matrix of policies. It was reformed and amended many times during the European history as it gave rise to many negative consequences:

- oversupply

- income inequality between the farms of different sizes

- negative impact on world food markets

- budget troubles

- environmental pollution etc.

Since the 1970s, many attempts have been made to reform the CAP. Thus, the most recent reforms of European agricultural policy represent an effort to reduce the distortion of incentives caused by price support while continuing to provide aid to farmers. Should politicians go through with their plans, farmers would increasingly receive direct payments that are not tied to how much they produce. As a result, agricultural prices will slightly fall and production will be reduced.

Brexit and the European Common Agricultural Policy (CAP)

In 2016 when the UK said 'Yes' to Brexit and decided to leave the EU, the impact on the agriculture in the UK posed many questions. Before Brexit, more than 50 % of the UK's total income from agriculture used to come from the European CAP.

|

| European Common Agricultural Policy and Brexit |

Before Brexit, British farmers have profited from the CAP for more than 40 years. Moreover, the UK used to be an important contributor to the EU budget, providing 10.5% of its funding. Almost 40% of the total EU budget is driven towards the European CAP which renders £3bn a year in form of subsidies for the British agriculture. What will happen after Brexit?

At the moment, no one can predict what sort of relations will be between the EU and the UK. While many British farmers risk quitting the business because of the rapid fall in prices as well as decrease in land value. However, not being obliged to contribute to the EU budget means, that a sort of "Brexit dividend" will be left to spare. How exactly the Brexit surplus will be used and whether its large part will be spent on agriculture, will predetermine the destiny of British rural economics.

Despite what is often said on the media, it is not only the old people who voted for Brexit. The disillusionment came from different circles. Among farmers, the main source of discontent consisted in the rigid European rules and regulations, excessive paperwork and abusive centralisation.

Saying that the European experiment was a failure would be too strong and incorrect. It was its directions that were incorrect. European integration started with economic integration, but did not see its tasks through to the end. Instead, it turned into a cumbersome, bureaucratic institution which masked its incompetence behind the vague political paroles. Brexit is a signal that many things need to be reformed and in some aspects it would be good to get back to the roots. What cannot be denied, however, is that European economic cornerstones among which is the CAP, should be kept, but adjusted to the real life.

At the moment, no one can predict what sort of relations will be between the EU and the UK. While many British farmers risk quitting the business because of the rapid fall in prices as well as decrease in land value. However, not being obliged to contribute to the EU budget means, that a sort of "Brexit dividend" will be left to spare. How exactly the Brexit surplus will be used and whether its large part will be spent on agriculture, will predetermine the destiny of British rural economics.

Despite what is often said on the media, it is not only the old people who voted for Brexit. The disillusionment came from different circles. Among farmers, the main source of discontent consisted in the rigid European rules and regulations, excessive paperwork and abusive centralisation.

Saying that the European experiment was a failure would be too strong and incorrect. It was its directions that were incorrect. European integration started with economic integration, but did not see its tasks through to the end. Instead, it turned into a cumbersome, bureaucratic institution which masked its incompetence behind the vague political paroles. Brexit is a signal that many things need to be reformed and in some aspects it would be good to get back to the roots. What cannot be denied, however, is that European economic cornerstones among which is the CAP, should be kept, but adjusted to the real life.